Motivate staff and teams

Prepare your business for the Employment (Allocation of Tips) Bill

Key steps to staying UK tipping legislation compliant

- Individual tips

- Team tips

Step 1

Fair and transparent distribution of tips

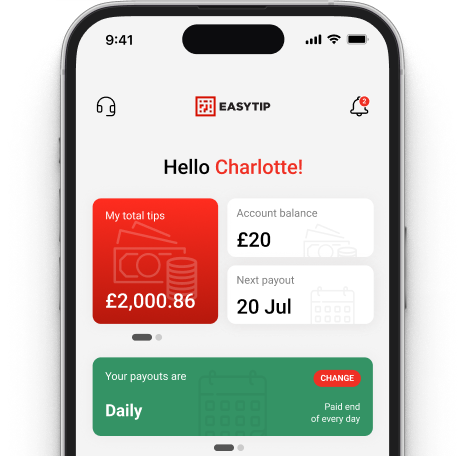

With EasyTip’s individual tipping method, tips are sent instantly and directly from customers to the recipient.

- Employees see tips instantly

- The employer doesn’t control or see individual transactions so is not obligated to report or bare responsibility

Step 2

Allocation and payment of tips by month's end

EasyTip individual tips are paid out depending on the schedule the tip recipient chooses. These schedules are instant, daily, weekly or fortnightly.

- Compliant with new regulations

- Tip recipients control payouts not employer

- Tip recipients can receive tips faster than in traditional collection methods

Step 3

Ensuring full tip allocation

EasyTip individual tips are paid out in full to their tip recipients. The employer cannot and does not withhold any fees from such tips.

- Compliant with new regulations

- Tip recipients receive 100% of all tips

Step 4

Clear and accessible tipping policy for staff and customers

The EasyTip app generates a digital tipping policy for you and your staff depending on the configurations you choose. This policy is accessible in the app and can be downloaded if required.

Step 5

Record-keeping of employee tips over three years

With EasyTip, every transaction is at your fingertips. Just like with any banking app, users have access to configurable account statements and can see all tips, distributions, and payouts for any period of time.

Step 6

Agency workers must receive equal and fair share of tips

With EasyTip, you can add any staff member to your tip recipient list be they an employee or an agency worker.

Step 1

Fair and transparent distribution of tips

EasyTip’s common tips collection process, provides a set of automated tronc tools for businesses to manage their own tronc schemes in a fair and transparent way.

- Distributions based on transparent and fair rules

- Options to distribute tips directly to employees from EasyTip or via employer payroll

Step 2

Allocation and payment of tips by month's end

EasyTip common tips are paid out as frequently as the troncmaster wishes. Hourly, daily, weekly or monthly – all the troncmaster needs to do is allocate the tips for the given period.

- Compliant with new regulations

- Troncmaster controls frequency of payouts

Step 3

Ensuring full tip allocation

EasyTip common tips are paid out in full to their tip recipients. The employer cannot and does not withhold any fees from such tips.

- Compliant with new regulations

- Tip recipients receive 100% of all tips

- Option for customers to fully cover platform fees

Step 4

Clear and accessible tipping policy for staff and customers

The EasyTip app generates a digital tipping policy for you and your staff depending on the configurations you choose. This policy is accessible in the app and can be downloaded if required.

Step 5

Record-keeping of employee tips over three years

With EasyTip, every transaction is at your fingertips. Just like with any banking app, users have access to configurable account statements and can see all tips, distributions, and payouts for any period of time.

Step 6

Agency workers must receive equal and fair share of tips

With EasyTip, you can add any staff member to your tip recipient list be they an employee or an agency worker.

Transform your tips collection and distribution and see your business grow

Earn more tips

Full transparency for everyone

Attract best talent

Direct and instant tipping

Reduced admin

Insightful reviews

No tipping app required to tip

Want to find out more about how our tipping platform can help your business?