Reporting tips made easy

.webp?width=522&height=522&name=download%20(15).webp)

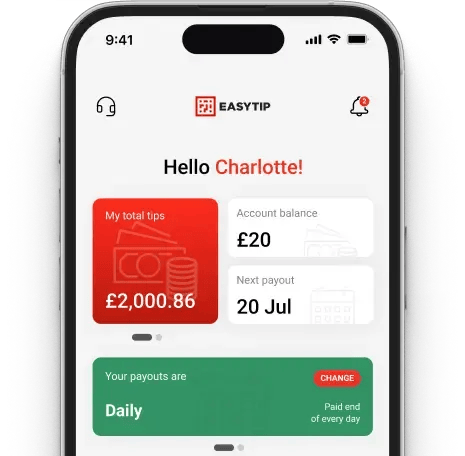

Reporting cashless tips through PAYE scheme

If the business you work for has signed up to EasyTip’s “Employer reporting” option then your tips will be reported by your employer through the PAYE scheme and the necessary tax will be automatically deducted from your pay.

You can check this with your employer or see what tax reporting option your EasyTip account is set to by checking your profile page on the EasyTip cashless tipping app dashboard.

And that’s it! There’s nothing more for you to do.

Earned less than £2500 in tips?

If you are an employee and have earned less than £2500 in tips in a tax year (all tips not just via EasyTip tipping app) but the business you work for does not report your tips through your payslip, you will need to self-report these tips to HMRC.

.png?width=122&height=120&name=Group%20336%20(1).png)

Self-assessment tax return

Allows you to report a range of additional incomes and offset appropriate costs and deduction

Tax code update

With one quick call or simple letter per year it couldn’t be easier to inform HMRC to tips earned! Updating your tax code means income tax due on up to £2500 in tips earned in the previous tax year will be automatically deducted through your future payslips via PAYE with no hassle for you or your employer.

.png?width=119&height=120&name=Group%20335%20(1).png)

Personal tax return

Allows you to estimate taxes, check your records and quickly update details in the future.

Earned more than £2500 in tips?

If you are an employee and have earned more than £2500 in tips in a tax year (all tips not just via EasyTip), but the business you work for does not report your tips through your payslip, then you will need to complete and submit a self-assessment form below.

.png?width=122&height=120&name=Group%20336%20(1).png)

Self-assessment tax return

Allows you to report a range of additional incomes and offset appropriate costs and deduction

Personal tax return

Allows you to estimate taxes, check your records and quickly update details in the future.

Reporting cashless tips through PAYE scheme

If the business you work for has signed up to EasyTip’s “Employer reporting” option then your tips will be reported by your employer through the PAYE scheme and the necessary tax will be automatically deducted from your pay.

You can check this with your employer or see what tax reporting option your EasyTip account is set to by checking your profile page on the EasyTip cashless tipping app dashboard.

And that’s it! There’s nothing more for you to do.

.webp?width=522&height=522&name=download%20(15).webp)

Earned less than £2500 in tips?

If you are an employee and have earned less than £2500 in tips in a tax year (all tips not just via EasyTip tipping app) but the business you work for does not report your tips through your payslip, you will need to self-report these tips to HMRC.

.png?width=122&height=120&name=Group%20336%20(1).png)

Self-assessment tax return

Allows you to report a range of additional incomes and offset appropriate costs and deduction

Tax code update

With one quick call or simple letter per year it couldn’t be easier to inform HMRC to tips earned! Updating your tax code means income tax due on up to £2500 in tips earned in the previous tax year will be automatically deducted through your future payslips via PAYE with no hassle for you or your employer.

.png?width=119&height=120&name=Group%20335%20(1).png)

Personal tax return

Allows you to estimate taxes, check your records and quickly update details in the future.

Earned more than £2500 in tips?

If you are an employee and have earned more than £2500 in tips in a tax year (all tips not just via EasyTip), but the business you work for does not report your tips through your payslip, then you will need to complete and submit a self-assessment form below.

.png?width=122&height=120&name=Group%20336%20(1).png)

Self-assessment tax return

Allows you to report a range of additional incomes and offset appropriate costs and deduction

Personal tax return

Allows you to estimate taxes, check your records and quickly update details in the future.

HMRC Contacts

![]()

Monday to Friday 6am to 6pm

Closed on weekends and bank holidays

![]()

Telephone: 0300 200 3300

Outside UK: +44 135 535 9022

![]()

Pay As You Earn and Self Assessment

HM Revenue and Customs BX9 1AS United Kingdom

Useful links and downloads

Tipping made simple. Cashless, compliant & instant.

Enjoy up to 25% more in earnings, happier staff, and stable cashflow.