Reporting tips made easy

Sorting out the tax on tips you earned is simple. With our cashless tipping app, your transactions are at your finger tips, keeping track and reporting them is now quicker and more hassle free than ever! Use our guide below to get started.

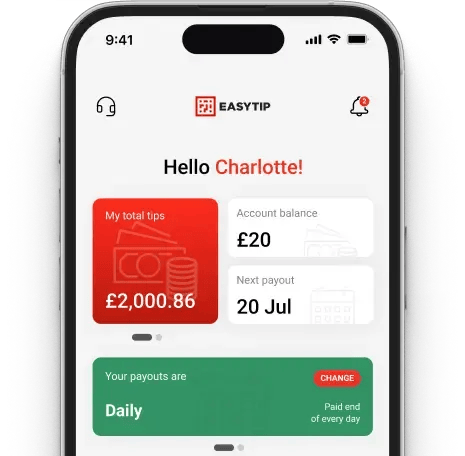

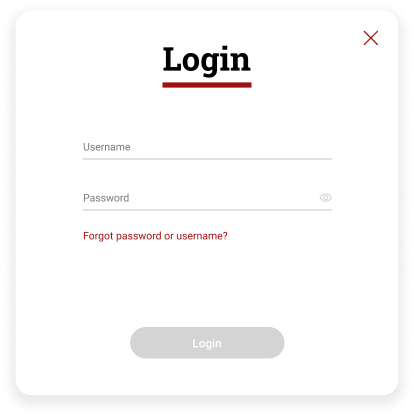

1. Login to EasyTip,

your favorite tipping app!

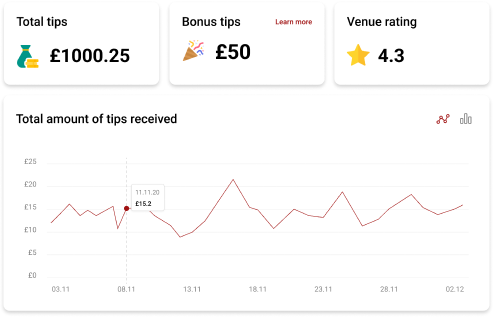

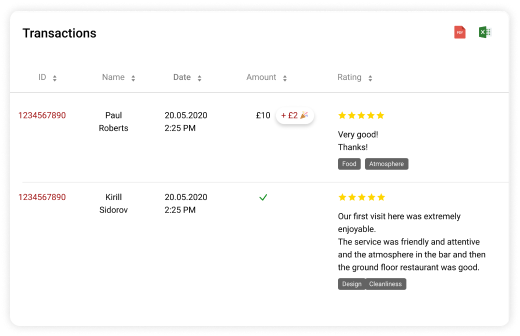

2. Open reporting page

and select the dates to calculate tips

3. Use total amount of tips

for HMRC reporting

(remember to include any other tips you recieved that are not via EasyTip)

How do I declare my cashless tips?

If you are self-employed, you can declare how many tips you earned to HMRC in a number of ways. Select from the options below to understand how you can report your tax on tips.

Self-assessment tax return

Allows you to report a range of additional incomes and offset appropriate costs and deduction

Personal tax return

Allows you to estimate taxes, check your records and quickly update details in the future.

Self assessment for 2022/23 should be submitted

by January 31st 2024

HMRC Contacts

![]()

Monday to Friday 6am to 6pm

Closed on weekends and bank holidays

![]()

Telephone: 0300 200 3300

Outside UK: +44 135 535 9022

![]()

Pay As You Earn and Self Assessment

HM Revenue and Customs BX9 1AS United Kingdom

Useful links and downloads

Loved by 2,500+ business owners

№1 Cashless Tipping in the UK

Tipping made simple. Cashless, compliant & instant.

Enjoy up to 25% more in earnings, happier staff, and stable cashflow.